Environmental, Social and Governance, or ESG, is replacing Corporate Social Responsibility (CSR), as the way responsible businesses should operate today.

In recent years, investors have shown an interest in putting their money where their values are. Evidence of ESG activity is now seen as vital to understanding a company’s purpose, strategy and management quality.

In response, brokerage firms and mutual fund companies have begun to offer financial products that follow ESG investing trends. In fact, a quarter of the world’s professionally-managed investment funds now only invest in companies that demonstrate strong ESG qualifications.

CSR and ESG Differences

CSR is a form of self-regulation that most large companies report on yearly. It represents a company’s efforts to have a positive impact on its employees, consumers, the environment and the community at large.

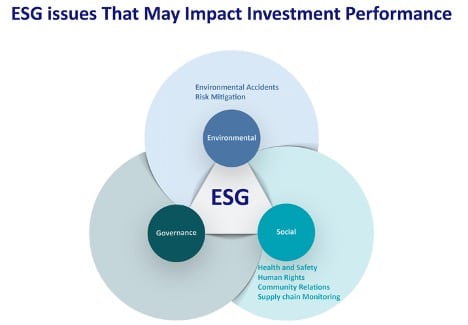

In contrast, ESG measures these activities to reach a more exact assessment of a company’s activities in the following areas:

- Their response to climate change

- How they treat their employees

- How they build trust and encourage innovation

- How they manage their supply chains

ESG uses metrics, which are tools that measure a company’s performance. For example, environmental programs consider how a company performs as a steward of nature. Programs that show how many kilowatts of energy were saved, how many tons of carbon emissions were avoided or the gallons of water that were preserved, are metrics that can be measured.

Social criteria examine how a company manages relationships with employees, suppliers, customers and the communities they conduct business in. Governance deals with a company’s leadership, executive pay, audits, internal controls and shareholder rights. Such programs also have targets for improvement from year to year.

ESG covers social issues like a company’s labour practices, talent management, product safety and data security. It also covers governance matters such as board diversity, executive pay and business ethics.

Why ESG is Important

ESG standards are an increasingly popular way for investors to evaluate companies in which they might want to invest.

Many mutual funds and brokerage firms now offer products that employ ESG criteria. This can help investors to avoid companies that might be a greater financial risk due to their less than ideal practices regarding the environment or other issues.

ESG Investing 101 – ESG Funds

ESG investing is also known as sustainable investing, responsible investing, impact investing or socially responsible investing.

An ESG fund is a portfolio of equities and/or bonds that have had environmental, social and governance factors incorporated into the investment process. That means that equities and bonds contained in the fund have passed rigorous tests regarding how sustainable the company is regarding its ESG standards.

An ESG fund should contain only those securities with a high sustainability score and would exclude companies with, for example, poor records on pollution, labour relations or management practices. The same standards would apply to governments.

ESG data from research shows that using ESG in security selection leads to better-informed investment decisions. Sustainability funds can do better than non-sustainable ones, partly because of better risk management over controversial issues For example, companies with a lower carbon footprint would face lower regulatory or societal risk than a polluter, so its shares should be less unpredictable over time.

ESG funds are becoming more popular among investors who want to be seen to be making a contribution to cutting global warming and adding to human development, without compromising financial returns.

How ESG Criteria Work

Investors look at a broad range of behaviours to assess a company based on environmental, social and governance criteria.

Environmental criteria may include a company’s:

- Energy use

- Waste

- Pollution

- Natural resource conservation

- Treatment of animals

This criteria can also be used to evaluate any environmental risks a company might face and how they manage those risks. These risks might include issues related to its ownership of contaminated land, how it disposes of hazardous waste, how it manages its toxic emissions or how it complies with government environmental regulations.

Social criteria involves a company’s business relationships, such as:

- Does it work with suppliers that share the same values as it claims to hold?

- Does the company donate a percentage of its profits to local charities?

- Does it encourage employees to volunteer in the community?

- Does the company’s working conditions demonstrate that they care about its employees’ health and safety?

- Does it take other stakeholders’ interests into account?

With regards to governance, investors may want to know that a company uses accurate and transparent accounting methods or that stockholders are given an opportunity to vote on important issues.

Investors may also want to be assured that companies avoid conflicts of interest in their choice of board members and don’t use political contributions to garner favourable treatment unduly. And, of course, investors want to know that a company doesn’t engage in illegal practices.

Investors need to decide what’s most important to them, as no single company may pass every test in every category.